February marks Heart Health Awareness Month, a time dedicated to raising awareness about cardiovascular health and encouraging individuals to take proactive steps toward maintaining a healthy heart. Heart disease remains one of the leading causes of death globally, highlighting the importance of understanding how to care for our hearts. According to the Centers for Disease Control and Prevention (CDC), about 695,000 people died from heart disease in 2021 in the United States which is 1 in every 5 deaths. * This month we will look at some important aspects of heart health, risk factors for heart disease, and tips for maintaining a healthy heart. Read more

The Internal Revenue Service released the annual maximum 2024 contribution limits for HSAs under high deductible health plans (HDHPs). For 2024, we will see the largest jump in recent years for contribution limits – mainly due to continued high inflation. The annual limit on HSA contributions for an individual will be $4,150 (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023). HSA “catch-up” contribution for participants 55 and older, can contribute an extra $1,000 to their HSA, which is the current amount in place for 2023.

Effective January 1, 2024 – Contribution Limits for Health Savings Accounts

| Tax Year | Individual Coverage Limit | Family Coverage Limit |

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

| At age 55, members are allowed to contribute an additional $1,000 | ||

What is a HSA? It is a tax-advantaged account, paired with a high-deductible health insurance plan (HDHP), that allows you to save pre-tax dollars for future qualified medical expenses. You can invest the funds in the HSA account tax-free and grow your savings. You own the account, it travels with you if you change jobs, change your health plan, or retire.

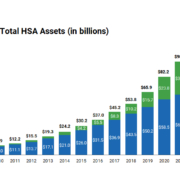

The IRS has released the contribution limits for Health Savings Accounts (HSA) for 2023 and the numbers are significantly higher than in prior years, as you can see from the chart below. Knowing these numbers will help employers prepare for open enrollment and think about their contribution levels as well as help employees understand the benefits of contributing to their HSAs.

| Tax Year | Individual Coverage Limit | Family Coverage Limit |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

| 2021 | $3,600 | $7,200 |

| At age 55, members are allowed to contribute and additional $1,000 | ||

What is a HSA? It is a tax-advantaged account, paired with a high-deductible health insurance plan (HDHP), that allows you to save pre-tax dollars for future qualified medical expenses. You can invest the funds in the HSA account tax-free and grow your savings. You own the account, it travels with you if you change jobs, change your health plan, or retire.

The new California Law, SB 1375, was signed by Governor Brown on September 22, 2018 and will affect many small firm’s group health insurance. SB 1375 changes the Health Insurance Code to reclassify certain small employer groups as individuals. The affected firms will have to obtain individual health insurance in 2019, rather than the small employer group plans they currently have. Individual health insurance is typically more expensive with less provider network and benefit plan choices than small group plan offerings.

The new California Law, SB 1375, was signed by Governor Brown on September 22, 2018 and will affect many small firm’s group health insurance. SB 1375 changes the Health Insurance Code to reclassify certain small employer groups as individuals. The affected firms will have to obtain individual health insurance in 2019, rather than the small employer group plans they currently have. Individual health insurance is typically more expensive with less provider network and benefit plan choices than small group plan offerings.

Fortunately, for CalCPA members and their firms, CalCPA Health received certain exemptions from SB 1375, which generally allows us to treat the affected firms as groups, and not as individuals. Commercial carriers (Blue Shield, UnitedHealthcare, Anthem, etc.,) must comply with the new regulations and reclassify these groups as individuals.

SB 1375 defines groups that consist entirely of owners/partners, and/or W-2 employees that are spouses of owner/partners, as not eligible for group health coverage. Even though these entities may be classified as employer/employees by other regulations, (e.g. Workers’ Comp, payroll tax, etc.,) SB 1375 specifically states they do not qualify for group health coverage and may only purchase individual plans.

The Patient Protection and Affordable Care Act (ACA) is exceedingly vast. It deals with all aspects of the medical delivery system including insurance. Combine this with the numerous changes California is implementing and the result is tens of thousands of pages, comprising both federal and state regulations.

This book focuses on the key elements that affect California CPAs. Therefore, we will concentrate on those ACA regulations that are being adopted and implemented in California. And, while other states may have slightly different implementations, they will not be specifically addressed here.

Our intent is that you may use this book as a reference for the areas that are of particular interest to you, or those areas that expressly affect you. For example, if you are with a small firm and do not have any “large employer” clients, the large employer sections may be of less value to you than the information on small employers.

Resources

Plans & Services

News

Contact Us

Monday – Friday,

8am to 5pm (PST)

(877) 480-7923

Click below to contact our

Banyan Customer Service Team