2024 Contribution Limits for Health Savings Accounts (HSA) Announced

The Internal Revenue Service released the annual maximum 2024 contribution limits for HSAs under high deductible health plans (HDHPs). For 2024, we will see the largest jump in recent years for contribution limits – mainly due to continued high inflation. The annual limit on HSA contributions for an individual will be $4,150 (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023). HSA “catch-up” contribution for participants 55 and older, can contribute an extra $1,000 to their HSA, which is the current amount in place for 2023.

Effective January 1, 2024 – Contribution Limits for Health Savings Accounts

| Tax Year | Individual Coverage Limit | Family Coverage Limit |

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

| At age 55, members are allowed to contribute an additional $1,000 | ||

What is a HSA? It is a tax-advantaged account, paired with a high-deductible health insurance plan (HDHP), that allows you to save pre-tax dollars for future qualified medical expenses. You can invest the funds in the HSA account tax-free and grow your savings. You own the account, it travels with you if you change jobs, change your health plan, or retire.

To qualify for a HSA you must be enrolled in a qualified high-deductible health plan and meet the following criteria:

- Must be a U.S. taxpayer

- May not be covered by another non-qualified plan (including Medicare coverage)

- May not be claimed as a dependent on someone else’s tax return

- May not be receiving Veterans Affairs benefits within the past three months

Qualified high-deductible health plans typically offer lower premiums, allowing both the employer and employee reduced costs. Employees and employers can put the money they would normally have spent on premiums, into the HSA and build account balances for future medical expenses.

The investment side of HSAs is often overlooked. HSAs allow for long-term savings, similar to a 401K account. The difference however is that the HSA allows you to take tax-free distributions for qualified medical expenses. Withdrawals from a HSA, contributions, and investment gains, if used for medical expenses are not taxed (federal). And if non-medical distributions are taken in retirement, it is taxed similarly to an IRA/401k.

According to a recent report, the average retired couple age 65 in 2022 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.* Knowing the facts will help people not only save future spending dollars in their HSA account but also help them learn how to comparison shop for healthcare procedures or providers.

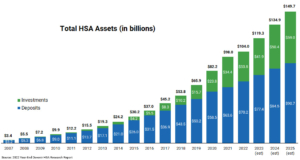

Enrollment in Health Saving Accounts continues to grow and employers see that these accounts help attract new employees as well as retain them. Knowing these numbers will help employers prepare for open enrollment (coming up in the 4th quarter) and think about their contribution levels as well as help employees understand the benefits of contributing to their HSA and utilizing the account to the fullest. Education is key – CalCPA Health can help answer questions you may have about HSAs – contact us whether you are enrolled in one of our medical plans or not. We are here to help the CalCPA community – info@calcpahealth.com.

* https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

Chart Source: Devenir Research https://www.devenir.com/research/2022-year-end-devenir-hsa-research-report/

Leave a Reply

Want to join the discussion?Feel free to contribute!