HSAs are most successful when the employer can educate employees about the benefits of these plans. Being a leader in the HSA industry, CalCPA Health stresses the importance of HSA education, which is likely the reason why 44% of their membership has enrolled in an HSA (national average is approximately 30%).

Education is key

First, is your firm eligible for a HSA? HSAs are available to those with a qualifying high-deductible health plan. Along with this, the following criteria is necessary to be eligible:

- Employee must be a U.S. taxpayer

- Employee may not be covered by another qualified plan (including Medicare coverage)

- Employee may not be claimed as a dependent on someone’s tax return

- Employee may not be receiving Veterans Affairs benefits within the past three months

Triple-tax advantage being in a HSA

Qualified health plans typically offer lower premiums, allowing both the employer and employee to save each year. Employees can put the money that they would normally have spent on premiums, straight into their HSA account and build a savings for future medical expenses.

- Pre-tax payroll deductions*

- Tax-free earnings

- Tax-free distributions for qualified medical expenses

Something very important to know is the employee is the owner of their own HSA, which means that the entire balance rolls over year-after-year and stays with them even if they change their health plan, change jobs, or retire. These accounts pay for qualified medical costs with pre-tax dollars and can be funded by an employer, individuals, or both.

Knowing annual contribution limits

Every contribution that one makes reduces the annual tax bill. Some employers offer employee matching to motivate them to contribute to their accounts. Typically, the first year of being in a HSA can be challenging since it takes a while to build up funds in the account. So, it may be difficult paying out-of-pocket until the deductible is met. As an employer, there are ways to help your employees in this regard. Once people are in the plan for over a year, they typically begin to see the benefits of being in such a valuable plan.

| Tax Year | Individual Coverage Limit | Family Coverage Limit |

|---|---|---|

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

Note: The IRS allows those 55 and older to make “catch-up” contributions of $1,000 to their annual maximum amount.

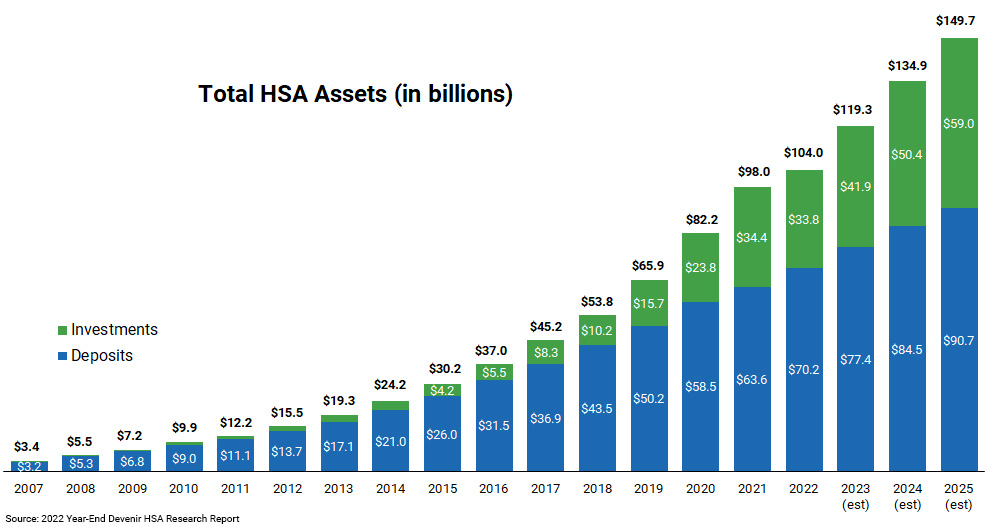

Investing with your HSA

The investment side of HSAs is often overlooked. HSAs allow for long-term savings, similar to a 401K account. The difference however is that the HSA allows you to take tax-free distributions for qualified medical expenses. According to a recent report, the average retired couple age 65 in 2021 may need approximately $300,000 saved (after tax) to cover health care expenses in retirement.** By educating your employees about potential costs in the future, you can help them become smarter healthcare consumers. Knowing the facts will help people not only save future spending dollars in their HSA account, but also help them learn how to comparison shop for healthcare procedures or providers.

CalCPA Health can help you with any questions you may have about HSAs and provide guidance with how you can help your employees have a better understanding of how HSAs can work for them. Contact CalCPA Health at info@CalCPAHealth.com or 650-522-5238.

* Payroll deferred HSA contributions are not subject to Social Security and Medicare (FICA) and federal unemployment (FUTA) taxes.

**https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs