Health Savings Accounts Compliment Your 401(k)

Spend smarter, save, and invest in your future healthcare expenses.

CalCPA Health offers a variety of Health Savings Accounts (HSAs) as well as PPO and HMO plans, but over the past several years, enrollment in Health Savings Accounts has skyrocketed. Roughly 45% of CalCPA Health subscribers are enrolled in an HSA (the national average is approximately 30%). Here are some reasons why HSAs are growing:

| Year | Single | Family |

|---|---|---|

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

CalCPA Health’s HSA plans provide CalCPA members with a unique program that offers High Deductible Healthcare Plans (HDHPs) combined with integrated banking and health claims administration through HealthEquity. The HSAs, when paired with a Health Savings Account offered through HealthEquity or a bank, brokerage, or another financial institution provides security against catastrophic medical expenses while allowing you to set aside pre-tax dollars to pay for qualified medical expenses. With an HSA, you generally pay lower premiums today while being able to build a special savings account designed to pay for or reimburse you for current and future qualified medical expenses.

Putting pre-tax dollars into an HSA can help pay for qualified medical expenses that Medicare won’t cover and help with dental, hearing, and vision expenses. Qualified medical expenses remain tax-free, even into retirement. After age 65, you can use your HSA much like a 401(k) and withdraw funds for any purpose.

Who is eligible for an HSA?

HSAs are available to those with a qualifying high-deductible health plan. Along with this, the following criteria are necessary to be eligible:

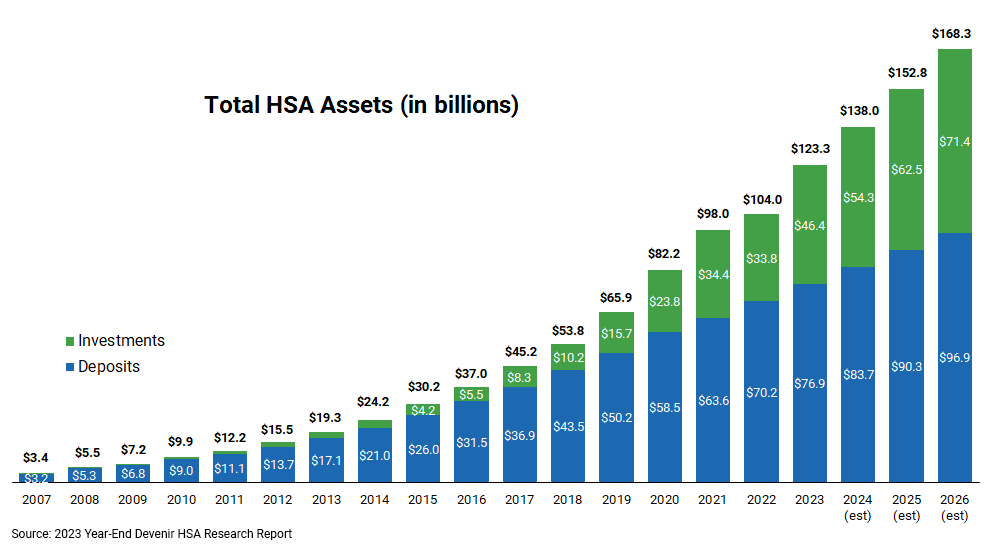

Investing with your HSA

The investment side of HSAs is often overlooked. HSAs allow for long-term savings, similar to a 401K account. The difference however is that the HSA allows you to take tax-free distributions for qualified medical expenses. According to a recent report, the average retired couple age 65 in 2023 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.** By educating your employees about potential costs in the future, you can help them become smarter healthcare consumers. Knowing the facts will help people not only save future spending dollars in their HSA, but also help them learn how to comparison shop for healthcare procedures or providers.

| 401(k) | HSA |

|---|---|

| FICA taxed contributions | 100% tax-deductible contributions |

| Tax-free earnings | Tax-free earnings |

| Medical expenses taxes as ordinary income | Tax-free distribution for medical expenses |

| Regular expenses taxed as ordinary income | Regular expenses taxed as ordinary income |

| Minimum distributions required | No required minimum distributions |

Education is key – we are here to help

Something important to know is the employee is the owner of their own HSA, which means that the entire balance rolls over year-after-year and stays with them even if they change their health plan, change jobs, or retire. These accounts pay for qualified medical costs with pre-tax dollars and can be funded by an employer, individuals, or both. Education is essential when it comes to switching over to an HSA – CalCPA Health is here to help. If you have questions about how HSAs work or if you would like to get a quote, please fill out the appropriate form to the right.

For more information on HSAs:

Contact CalCPA Health with your questions, calcpahealth@calcpahealth.com

Note: Review IRS guidelines for qualified medical expenses allowed under IRS Code 502 and consult a tax advisor regarding specific state requirements.

**https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-cost