By Ron Lang, CEO of CalCPA Health

October 2020

In the August 2020 CalCPA magazine, we reported that CalCPA Health firms adopt Health Saving Accounts (HSAs) at over twice the rate of the general population. Many in the profession appear to understand HSA’s two primary benefits: lowering health care costs and saving for health care costs in retirement.

These benefits stem from HSA contributions, investment earnings and withdrawals not being federally taxed, (if used for qualified health care expenses). Many HSA articles tout their benefits and compare to them 401k/IRA’s. A simplistic analogy may be that money goes in like a traditional 401k/IRA and comes out like a Roth. Further, HSA’s are paired with lower premium, qualified high deductible health plans (HDHP).

Unbridled health care cost inflation has resulted with people incurring ever increasing deductibles and out-of-pocket costs. HSA’s provide the ability to pay these costs with tax advantaged dollars. While Flexible Spending Accounts (FSA) can fill a similar role, HSA’s have additional advantages. For one, HSA’s do not have the use-it-or-loose-it penalty of FSA’s. The HSA funds stay with the account owner through job changes and retirement. This means account balances can build-up over years and be invested to further accumulate. If withdrawals are made for other than qualified health care expenses they are treated similarly to traditional 401k/IRA’s. Also, the annual dollar contributions limits are higher for HSA’s than FSA’s.

With these tangible benefits why is everyone not enrolled in an HSA? Aversion to change and uncertainty. We hear this from our members; it’s less risky and easier to not change, and stay with traditional plans.

Education on how HSA plans work can make everyone more comfortable. Employers can adopt the plan, but if the employees are not given the right tools to understand their role, they may not use the HSA optimally; therefore not reaping all or maximizing the benefits of this vehicle.

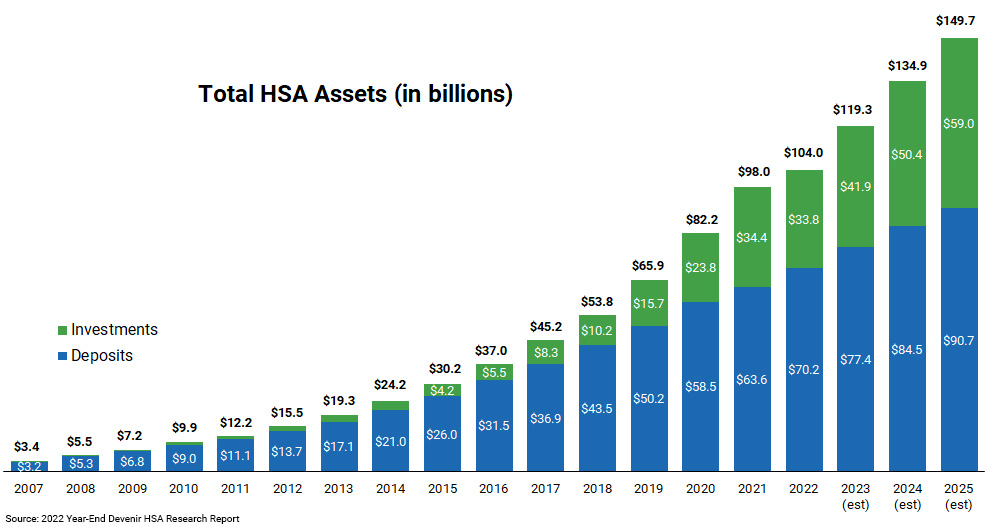

Administering HSA’s for the firm and employee can be more involved than traditional plans, but the market has matured significantly over the last half-decade making it administratively simpler. Given our large population of HSA participants, CalCPA Health has been at the forefront of this effort and provides firms and employees a package of administrative tools and support not found elsewhere.

CalCPA Health helps educate members (whether they are in CalCPA Health medical plans or with another carrier) on how to establish, navigate and optimize HSA plans.

With an HSA, it is key to take advantage of tax savings and build your dollars for the future. You can maximize your contributions as the IRS allows:

| Year | Single | Family |

|---|---|---|

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

Like a 401k plan, it can be challenging to make the HSA savings-for-retirement value statement to some employees, especially younger ones. Lowering healthcare costs, current and future, may be a more tangible connect-the-dots for many. Paying qualified health care costs with HSA funds yields a lower effective net health care cost.

Of course, not everyone qualifies to contribute to an HSA. People with other first dollar coverage(s) or Medicare are the most common exclusions. And heavy heath care utilizers need to evaluate whether they are better off in an HSA/HDHP or traditional plans. Please note: when enrolled in Medicare (or a non-HDHP) you can still use accumulated HSA funds, it’s that additional contributions are not allowed.

A common misconception among many people is thinking that when they go on Medicare that their health care costs will be minimal. The reality is the average person currently entering retirement is estimated to need around $150k ($300k/couple) to cover out-of-pocket health care costs. Of course, this is an estimated average across the entire population, for a specific person it depends on how long they live and how much health care they consume. Most will not be able to accumulate HSA funds in this magnitude but having a good portion in a tax advantaged vehicle can certainly help. If health care inflation continues to run well over consumer inflation, as it has for decades, these estimated will most likely skyrocket by the time younger and middle age folks get to retirement.

All aspects of HSA’s cannot be reviewed in this short article, so please visit our HSA page or see our contact information to the right. You also can fill out the questions form and someone will reach out to you.

Be on the lookout for our next HSA article.