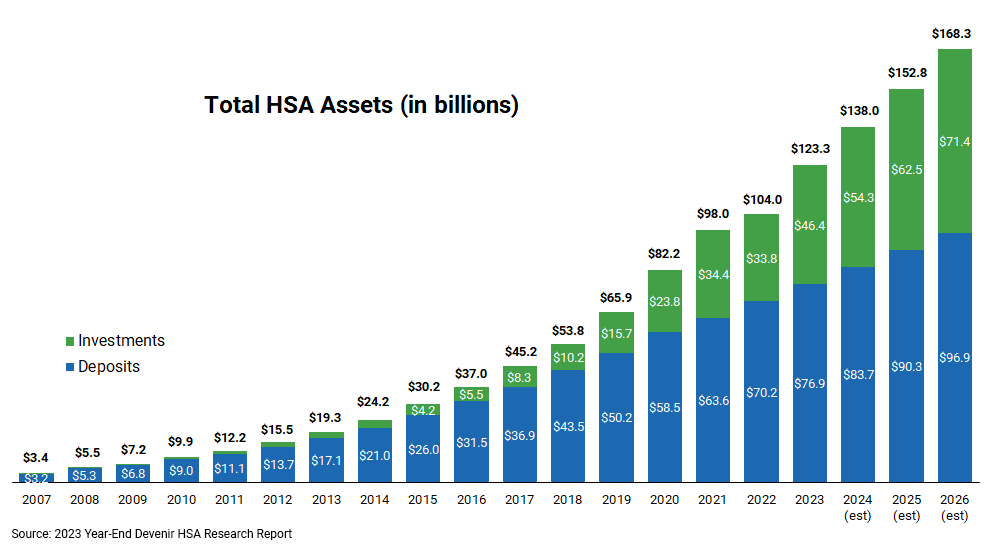

CalCPA Health has provided quality healthcare and benefit plans to CalCPA member firms since 1959 and one of our goals is to make choosing health and benefit plans easy for CalCPA members. Education is key when it comes to understanding health insurance plans. Over the past several years, national enrollment in Health Savings Accounts has grown at a fast pace. Currently 44% of the CalCPA Health population is in a HSA (substantially higher than the national average if about 30%). Here are some reasons why:

- Lower monthly premiums

- Tax advantaged contributions

- HSA funds roll over each year

- Keep your money even if you change jobs or insurance plans

- Investment options

- Tax-free interest earned

- Integrated banking and health claims administration

With an HSA, it is key to take advantage of tax savings and build your dollars for the future. You can maximize your contributions as the IRS allows:

| Year | Single | Family |

|---|---|---|

| 2024 | $4,150 | $8,300 |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

Health Savings Account Eligibility

HSAs are available to those with a qualifying high-deductible health plan. You also need to meet the following criteria:

- Must be a U.S. taxpayer

- May not be covered by another qualified plan (including Medicare coverage)

- May not be claimed as a dependent on someone’s tax return

- May not be receiving Veterans Affairs benefits within the past three months

Investing with your HSA

The investment side of HSAs is often overlooked. HSAs allow for long-term savings, similar to 401(k) accounts. The difference, however, is that the HSA allows you to take tax-free distributions for qualified medical expenses. According to a recent report, the average retired couple age 65 in 2021 may need approximately $300,000 saved (after tax) to cover health care expenses in retirement.* Understanding how HSAs work and knowing the potential costs in the future, will make you a smarter healthcare consumer. Knowing the facts will help you not only save future spending dollars in your HSA, but also help you learn how to comparison shop for healthcare procedures or providers.

Triple-Tax Advantage

Qualified health plans typically offer lower premiums, allowing both the employer and employee to save each year. You can put money that you would normally have spent on premiums, straight into your HSA account and build your savings for future medical expenses.

- Pre-tax payroll deductions**

- Tax-free earnings

- Tax-free distributions for qualified medical expenses

Something very important to know is YOU are the owner of your HSA, which means that the entire balance rolls over year after year and stays with you even if you change your health plan, change jobs, or retire. These accounts pay for qualified medical costs with pre-tax dollars and can be funded by an employer, individuals, or both. Putting away pre-tax dollars into an HSA can help pay for qualified medical expenses that Medicare won’t cover as well as help with dental, hearing, and vision expenses. Qualified medical expenses remain tax-free, even into retirement. After age 65, you can use your HSA much like a 401(k), and withdraw funds for any purpose.

For additional assistance with HSAs

Education is important when it comes to switching over to a HSA. CalCPA Health is here to answer your questions – whether you are enrolled with us or not. If you have questions about how HSAs work or if you would like to get a quote, please fill out the appropriate form to the right.

For more information on HSAs:

Note: Review IRS guidelines for qualified medical expenses allowed under IRS Code 502 and consult a tax advisor regarding specific state requirements.

*https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

** Payroll deferred HSA contributions are not subject to Social Security and Medicare (FICA) and federal unemployment (FUTA) taxes.